Subordinated Debt

Subordinated Debt

Access non-dilutive capital from market leaders in $100K to $10MM transactions without real estate or collateral.

Qualifications:

- 1+ Year in Business

- $1M+ in Annual Revenue

Access non-dilutive capital from market leaders in $100K to $10MM transactions without real estate or collateral.

Qualifications:

- 1+ Year in Business

- $1M+ in Annual Revenue

Empowering Growth with Flexible Funding

What Is Subordinated Debt Financing?

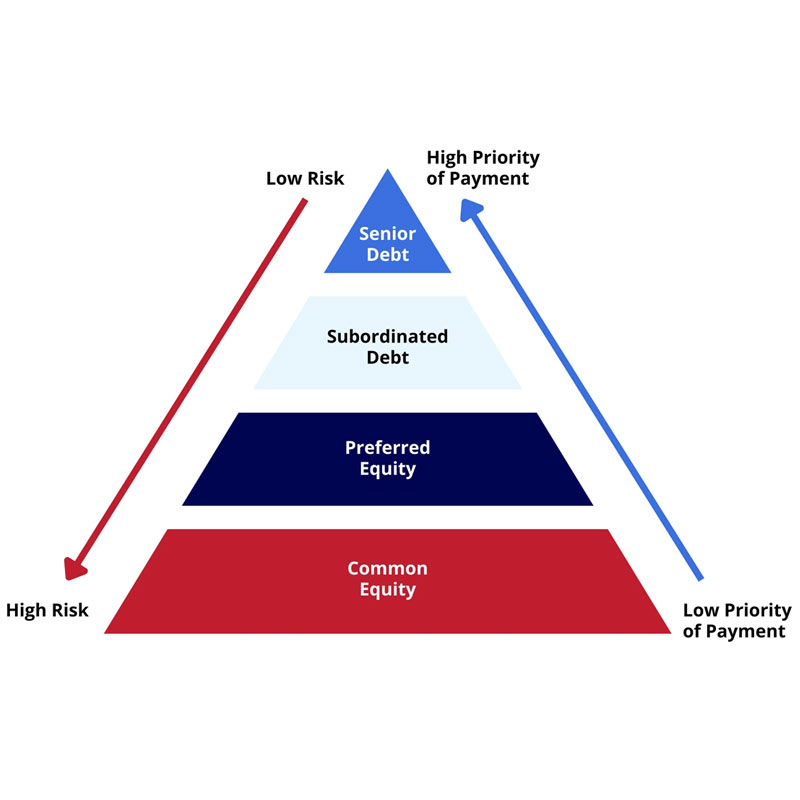

Subordinate debt is second-tier debt. The subordinate lender has a second lien position, whereas the senior lender retains the right to the first lien position.

The first position has the right to remain whole, meaning that they’re entitled to repayment before the second-tier lender.

Senior lenders are typically asset-based, while subordinated lenders can be any type of financial institution. Whether you’re a business owner, a private equity group, or a senior lender, subordinated debt financing is a powerful tool for accessing the capital necessary to complete transactions alongside a senior lender or to grow without having to pay off your senior lender.

How Does Subordinated Debt Financing Work?

Subordinate lenders are called upon to provide additional capital for continued growth when a senior lender can’t extend more credit, or a capital gap is delaying the completion of a transaction.

In most cases, there’s a gap between how much capital the business needs to accomplish its goals and what they have on hand. This can result from numerous situations, like a senior lender or private equity firm being unwilling to offer additional funding, but the reasons are basically all the same – there’s a need for capital that the senior lender or private equity firm cannot fulfill, but the subordinate lender can.

Once the transaction is funded, the senior retains the right to first position, and the second lien position applies to the subordinated lender for the sub debt.

Subordinate vs. Senior Lenders

The difference between subordinated and senior lenders is their lien position. Senior lenders have the right to remain whole, meaning they have the first lien position.

Subordinated lenders fall into the second lien position and aren’t repaid until the senior lender is “made whole” in a default situation.

Senior lenders are typically asset-based, whereas subordinate lenders can be any financial institution. Subordinated lenders enter the transactions, not leveraging the company’s assets, and provide second-lien subordinated debt.

Businesses, senior lenders, and private equity groups can utilize subordinated debt to help push transactions across the finish line.

When to Consider Sub Debt Financing

Sub debt is a powerful tool for entrepreneurs who are on the verge of completing large investments but don’t have every dollar they need to get the deal across the finish line.

This can happen for a variety of reasons, including shortfalls in collateral, insufficient buyer equity, and senior lenders being unwilling to offer additional capital to the business. Regardless of the reason, the business needs additional capital to complete its goals.

Here are a few situations where you should consider subordinate financing /sub debt:

- There is a need for an overadvance or more capital, but the senior lender is unwilling to provide additional capital.

- The business doesn’t have qualifying A/R, real estate, inventory, or other collateral to leverage.

- You’re trying to take on a new credit facility, and there is a gap.

- You’re trying to move senior financing off your balance sheet that’s no longer in the formula, or you popped a covenant.

What Do You Need to Apply?

NexxFund Financial makes subordinate debt financing easy by combining our 75+ lender marketplace and expert team to create a time-saving machine for entrepreneurs searching for the right lender.

To secure sub debt financing with NexxFund, you’ll need:

- Our Digital Application

- Prior Year’s Financials

- YTD Financials

- Prior Year’s Business Tax Return

- 6 Months of Business Bank Statements

$2+ Billion Financed

$2+ Billion Financed

Since 2007, NexxFund Financial has

accelerated business growth nationwide

Since 2007, NexxFund Financial has

accelerated business growth nationwide

Exclusive

Relationships

Our longstanding relationships with top B2B lenders allow clients to receive offers they can’t get anywhere else.

Personal

Advisors

Work with your dedicated Business Finance Advisor to personalize your financing to your unique needs.

Funding On

Your Timeline

Plan for future projects or cover immediate capital needs faster than with traditional banks.

Long Term

Perspective

You’re not getting just a loan. We aim to build a relationship that streamlines access to future capital.

Capital Without Compromise

Terms that allow you or your clients to Grow to Greatness.

Subordinated Debt Financing FAQs

APPLY FOR FUNDING

Fill out this quick form and our NexxFund Financial loan specialist will contact you!

Call A Specialist Today